Casino Win Loss Statement Example

- Casino Win Loss Statement Example Statement

- Casino Win Loss Statement Examples

- Casino Win Loss Statement Example Template

- Casino Win Loss Statement Example Sample

- Casino Win Loss Statement Example

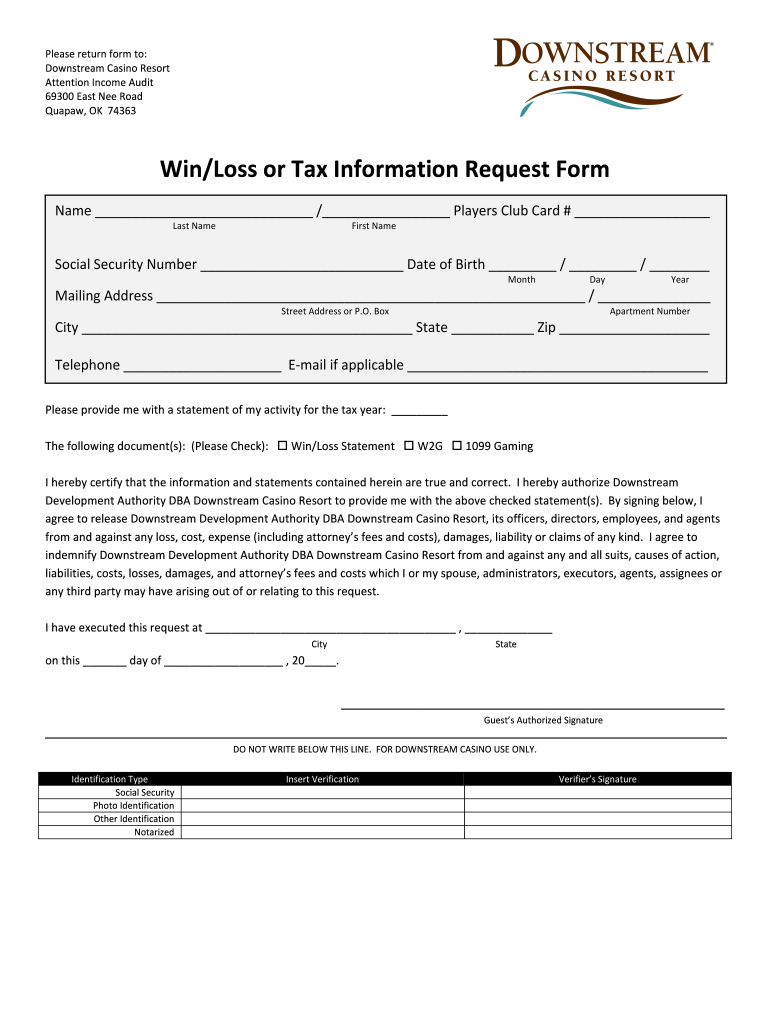

Two Ways to Obtain Your Win/Loss Tax Statement. PRINT YOUR OWN: Insert your Club Hollywood Card in any Kiosk on our Casino floor, follow the on-screen directions, and print your Win/Loss Tax Statement on your own. MYTH #3: I can use a win/loss statement from the Casino to prove my gambling losses. The IRS consistently disallows such win/loss statements from Casinos since they frequently report the amount of wins or losses as a “net” amount. (Remember, wins are reported on Page 1 of IRS Form 1040 and losses are reported on IRS Schedule A.).

Gamblers understand the concept of win some, lose some. But the IRS? It prefers exact numbers. Specifically, your tax return should reflect your total year’s gambling winnings – from the big blackjack score to the smaller fantasy football payout. That’s because you’re required to report each stroke of luck as taxable income — big or small, buddy or casino.

If you itemize your deductions, you can offset your winnings by writing off your gambling losses.

It may sound complicated, but TaxAct will walk you through the entire process, start to finish. That way, you leave nothing on the table.

How much can I deduct in gambling losses?

You can report as much as you lost in 2019 , but you cannot deduct more than you won. And you can only do this if you’re itemizing your deductions. If you’re taking the standard deduction, you aren’t eligible to deduct your gambling losses on your tax return, but you are still required to report all of your winnings.

Where do I file this on my tax forms?

Let’s say you took two trips to Vegas this year. In Trip A, you won $6,000 in poker. In the Trip B, you lost $8,000. You must list each individually, with the winnings noted on your return as taxable income and the loss as an itemized deduction in Schedule A. In this instance, you won’t owe tax on your winnings because your total loss is greater than your total win by $2,000. However, you do not get to deduct that net $2,000 loss, only the first $6,000.

Now, let’s flip those numbers. Say in Trip A, you won $8,000 in poker. In Trip B, you lost $6,000. You’ll report the $8,000 win on your return, the $6,000 loss deduction on Schedule A, and still owe taxes on the remaining $2,000 of your winnings.

What’s a W-2G? And should I have one?

A W-2G is an official withholding document; it’s typically issued by a casino or other professional gaming organization. You may receive a W-2G onsite when your payout is issued. Or, you may receive one in the mail after the fact. Gaming centers must issue W-2Gs by January 31. When they send yours, they also shoot a copy to the IRS, so don’t roll the dice: report those winnings as taxable income.

Don’t expect to get a W-2G for the $6 you won playing the Judge Judy slot machine. Withholding documents are triggered by amount of win and type of game played.

Expect to receive a W-2G tax form if you won:

- $1,200 or more on slots or bingo

- $1,500 or more on keno

- $5,000 or more in poker

- $600 or more on other games, but only if the payout is at least 300 times your wager

Tip: Withholding only applies to your net winnings, which is your payout minus your initial wager.

What kinds of records should I keep?

Keep a journal with lists, including: each place you’ve gambled; the day and time; who was with you; and how much you bet, won, and lost. You should also keep receipts, payout slips, wagering tickets, bank withdrawal records, and statements of actual winnings. You may also write off travel expenses associated with loss, so hang on to airfare receipts.

Use TaxAct to file your gambling wins and losses. We’ll help you find every advantage you’re owed – guaranteed.

More to explore:

Do you like gambling? You come to the casino, races or watch sports and bet on the wins, and that entire thrill is extremely valuable for you. Every time you play slots or poker, it sucks you in, entertains you and makes you come back for more. Every win and jackpot you get takes you to another level, makes you feel high. You love money and being in the casino.

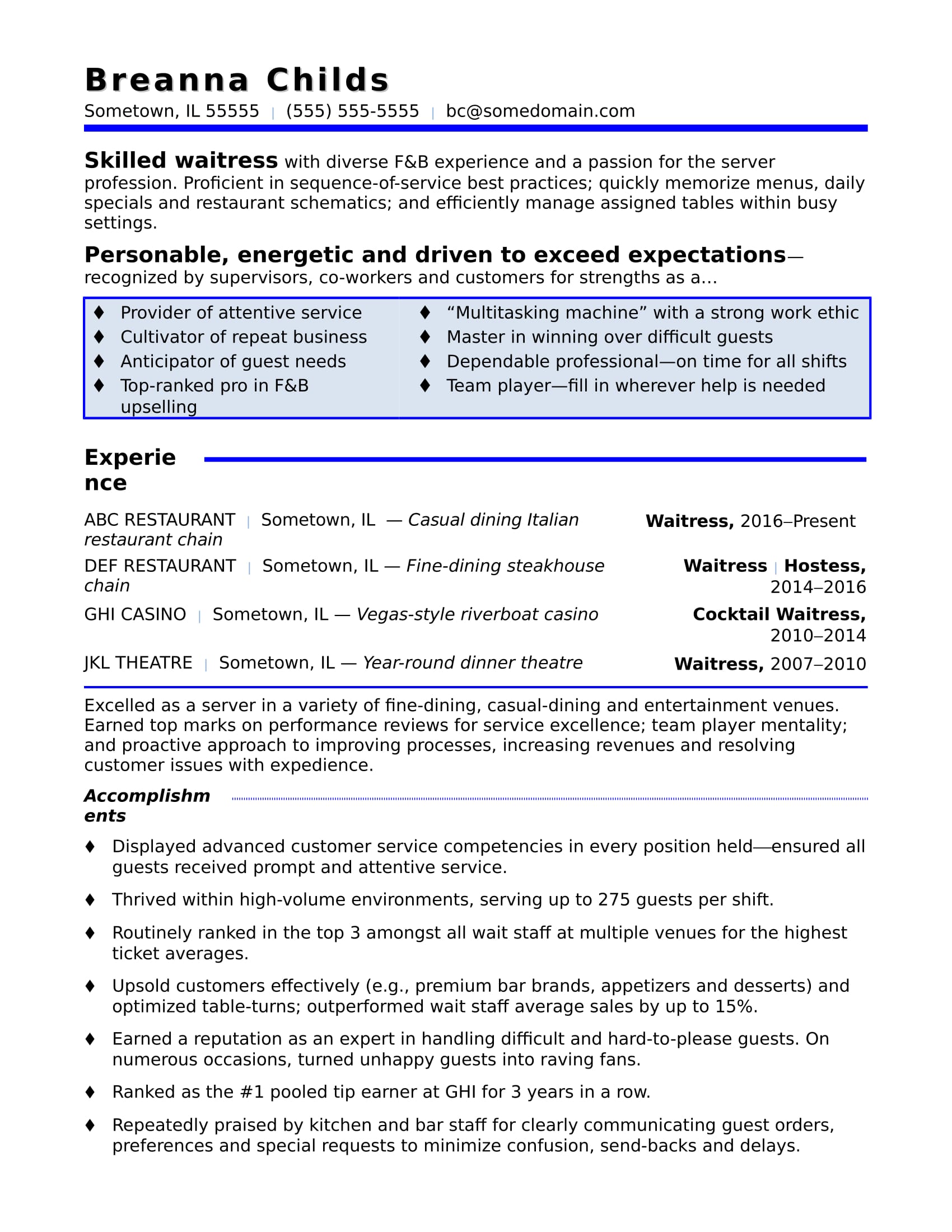

Casino Win Loss Statement Example Statement

Doesn’t matter if you’re an amateur, completely new oran established casino player, you must know what a win-loss statement is andhow it can influence your taxes.And in case you’re a fan of Cleveland Horseshoe Casino (now Jack ClevelandCasino), you must understand how to reada win-loss statement from Cleveland Horseshoe Casino.

As it’s essential to have your statement and know whatto do with it to continue gambling and profiting from it, getting money andliving on it, we’ll help you understand the win-loss statement from everycasino you visit. You won’t be scared to gamble anymore and will know how todeal with taxes.

About Cleveland HorseshoeCasino (Jack Cleveland Casino)

First, let’s talk about the Jack Cleveland Casino tounderstand the matter better and make it clearer. You can’t just judge thestatement of your favorite place before getting to know the history and whereit came from, right?

Jake Cleveland Casino is located in Cleveland, Ohio,in Higbee Building at the Tower City Center, making it extremely approachableand open to anybody over 21 years old, 24 hours a day. You can find it from theTower City Center, Public Square, and Terminal Tower. It’s big and has a lot topresent to the visitors. That includes:

- over 1500 slots;

- almost 40 electronic games;

- more than 100 table games.

It also partnered up with several hotels to providerooms and accommodation for the visitors, and so they can access the casinoquickly as they live nearby. Moreover, they made it possible to have meals anddrinks from the best restaurants that partnered up with this establishment.

History of the Casino

- TheHorseshoe Cleveland Casino was opened on May 14, the year 2009 as the casinoswere legalized in Ohio and other cities several years before that.

- Thiscasino became one of the best as its taxes were spent for good purposes,including the treatment and research of the gambling addiction, schools, othercities, developing rules for gambling in Ohio and other.

- InFebruary 2016 the casino was rebranded and remade into the Jack ClevelandCasino and provided better gambling access to the locals and tourists from thattime on.

What to Do Here

Of course, play! As soon as you enter, you will beable to play any game you like, be it slots, poker, baccarat or any other gamesfrom the hundreds on the list of the casino. You’re in luck if you like pokerthe most because they have a huge poker room. You can also rest and chill atthe lounge rooms, take a break and snack at the buffet and food court. If youwant to stay near the casino, it’s possible to book a room at the nearest hotelwith the partner. Or, in case you’re hungry for a pleasant meal, go to therestaurant and spend some time there before coming back to gambling.

So, when you’ve already understood that you preferthis casino and want to gamble here for some time, it’s just perfect to get toknow about your taxes and a win-loss statement from here.

What Is a Win-Loss Statement

You won’t really think that income from gambling issomething that would be counted as a legal income. Yet, that’s how reality is,and when your earnings are more than $1200, you need to fill out the specialform for your taxes every year. So, you better track all your times you went tothe casino.

The win-loss statement also works with:

- races (dog and horse);

- lottery;

- raffles;

- poker;

- sports betting.

Basically, a win-loss statement is what you’ve earned and lost throughout a year based on your information tracked either by you or the casino by using their customer card. It’s the best to track your own wins or losses, but requesting this document from the casino you visit the most will make the taxing process a lot easier for you.

When you want to see if your win-loss statement isgood enough for counting out the taxes and increasing your income, that’s whatyou should note down every time you gamble:

- the date of your gambling;

- type of gambling (poker, betting, slots, etc.)

- name of your casino and its full address;

- names of people you played with;

- how much you won and lost during the games.

Casino Win Loss Statement Examples

Why Do You Need a Win-Loss Statement?

Casino Win Loss Statement Example Template

You need your statement so you will get more incomefrom what you won. So, you will simply get fewer taxes if you report how muchyou lost during the game. The losses are deducted from your taxes.

You can count how much IRS (Internal Revenue Service)will deduct from taxes by counting how much you won and lost, and then usingthis method: a whole sum you won during the year minus how much you lost duringthe year.

Yet, you should note that you can’t use this method ifyou lost more than you won. You can only deduct the same amount. For example,if you won $15000 but lost $16000, you can only count $15000 as losses.

Same goes out to those, who think they can just minusout their losses from the taxes. You can only report the loss if you had won atleast once.

What’s in My Win LossStatement

Casino Win Loss Statement Example Sample

When you look at your win-loss statement, there arethings you should learn about it to read it right. In your win-loss statement,you have:

Casino Win Loss Statement Example

- Theestimated amount of dollars you won at the casino; in this situation, it’s ClevelandHorseshoe (Jack Cleveland) Casino. You can’t simply take this amount and giveit to your tax professional, you are required to keep track yourself andcompare those.

- Allyour losses as a negative amount.

- Theonly money that was recorded by the card from your casino.

- Onlywins from the slot and table games, not any other games you participated in.All the information is also not verified until you count it yourself andcompare.

Which winnings can be reported?

You should report the winnings as to count in yourannual taxes in cases like:

- you played slots or bingo machines and won more than$1200 this year;

- you played poker and won more than $5000 this year;

- you played a keno game and won more than $1500 thisyear.

All in all, gambling is not as easy as it can seem tosome people. If you truly love to gamble at the Jack Cleveland casino and wantto be serious about it, you need a win-loss report from this casino. Moreover,it will be counted in your taxes when you win more than $1200 on the mostpopular games. Now you know how to read a win-loss statement from pastCleveland Horseshoe Casino, now Jack Cleveland Casino. Good luck, player!